california sales tax payment plan

Not only is this the highest base rate in the country but some counties and cities charge even higher rates. Special Taxes.

California Announces Sales Tax Payment Plan For Small Businesses

Changes to the California Sales Tax in 2021.

. The state tax rate the local tax rate and any district tax rate that may be in effect. Effective April 2 2020 small businesses with less than 5 million in taxable annual. BREAKING NEWS Effective April 2 2020 California is granting small businesses 12 months to gradually remit the sales taxes that they have collected from customers.

A sellers permit is issued to business owners and. California Announces Sales Tax Payment Plan for Small Businesses due to COVID-19. Pay including payment options collections withholding and if you cant pay.

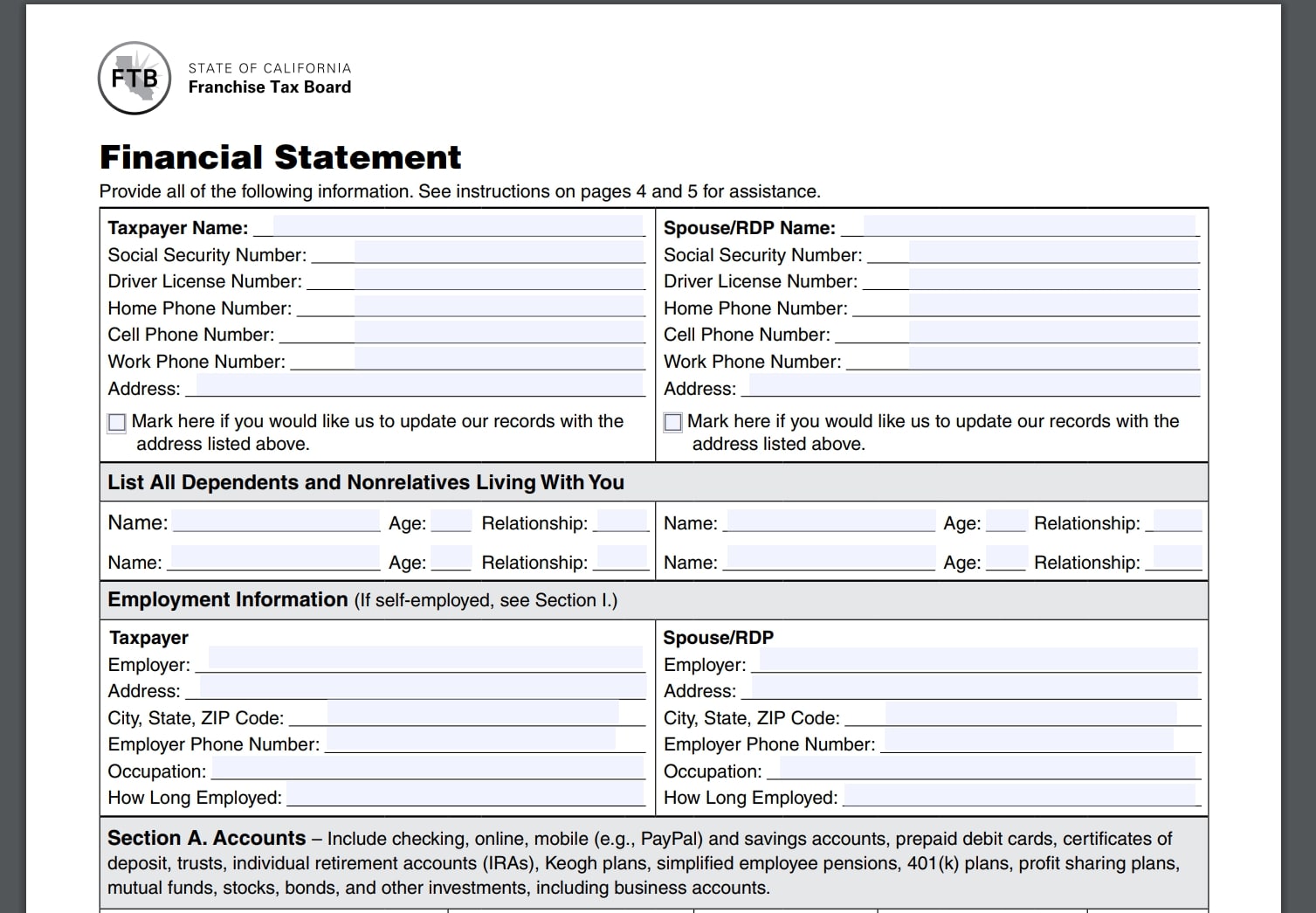

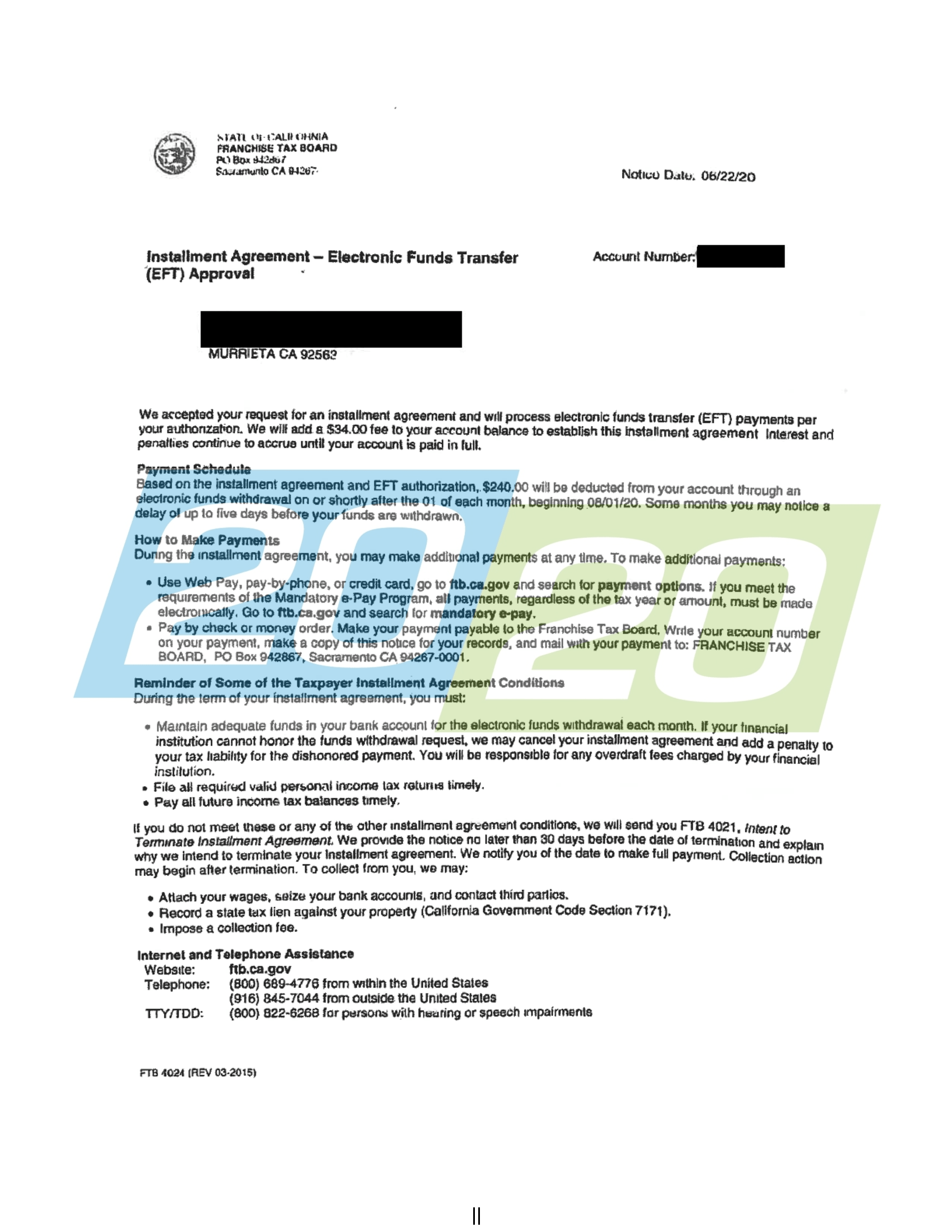

By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO. Sales. California Announces Sales Tax Payment Plan for Small Businesses due to COVID-19.

You may be required to pay electronically. Bank account - Web Pay Free Credit card service fee Payment plan setup fee. State sales and use taxes provide.

You may be required to pay electronically. Make monthly payments until my tax bill is paid in full. It may take up to 60 days to process your request.

State Local and District Sales and Use Tax Return CDTFA-401 PDF General Resale Certificate CDTFA-230 PDF. The California sales tax is a minimum of 725. For the approximate 995 of business taxpayers.

Wisconsin businesses can request to pay sales and use tax returns due April 30 2020 by June 1 2020 instead. Pay a 34 setup fee that will be added to my balance due. Box 2952 Sacramento CA 95812-2952.

Small businesses have a longer time to file their returns. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. Payment plan setup fee Check or money order.

Under the Payments section select Request a Payment Plan to begin your request. Simplified income payroll sales and use tax information for you and your business. Larger businesses can apply for a 12-month interest-free payment plan.

You can request a payment plan and pay down your. Pay including payment options collections withholding and if you cant pay. This is only an extension on time to file not pay.

Keep enough money in. Pay by automatic withdrawal from my bank account. Businesses with 5 million or more in annual taxable sales in sectors particularly impacted by operational restrictions due to the pandemic may also apply for this 12-month interest-free.

Most retailers even occasional sellers of tangible goods are required to register to collect sales or use tax in California. Effective April 2 2020 qualified small businesses can take advantage of a sales. Electronic funds withdrawal EFW Business.

An application fee of 34 will be. You can register online for most sales and use tax accounts and special tax and fee programs. The sales and use tax rate in a specific California location has three parts.

Providing a three-month extension for a tax return or payment to any businesses filing a return for less than 1 million in tax.

Cavuto Presses California Assemblyman Over Wealth Tax Plan Amid Millionaire Jailbreak From Golden State Fox Business

California Democrats Split On Tax Plan To Drive Ev Sales

What You Need To Know About California Sales Tax Smartasset

California Use Tax Information

How To Start A Business In California In 8 Steps 2022 Guide Shopify Ireland

Stop Wage Garnishments From The California Franchise Tax Board Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

What You Need To Know About California Sales Tax Smartasset

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Ca Homeowners Here S How The Gop Tax Plan Might Affect You Kpcc Npr News For Southern California 89 3 Fm

Member Blog The Most Common Gotchas When Calculating Dispensary Sales Tax In California

Secured Property Taxes Treasurer Tax Collector

How To Request A Payment Plan Youtube

California Sales Tax Small Business Guide Truic

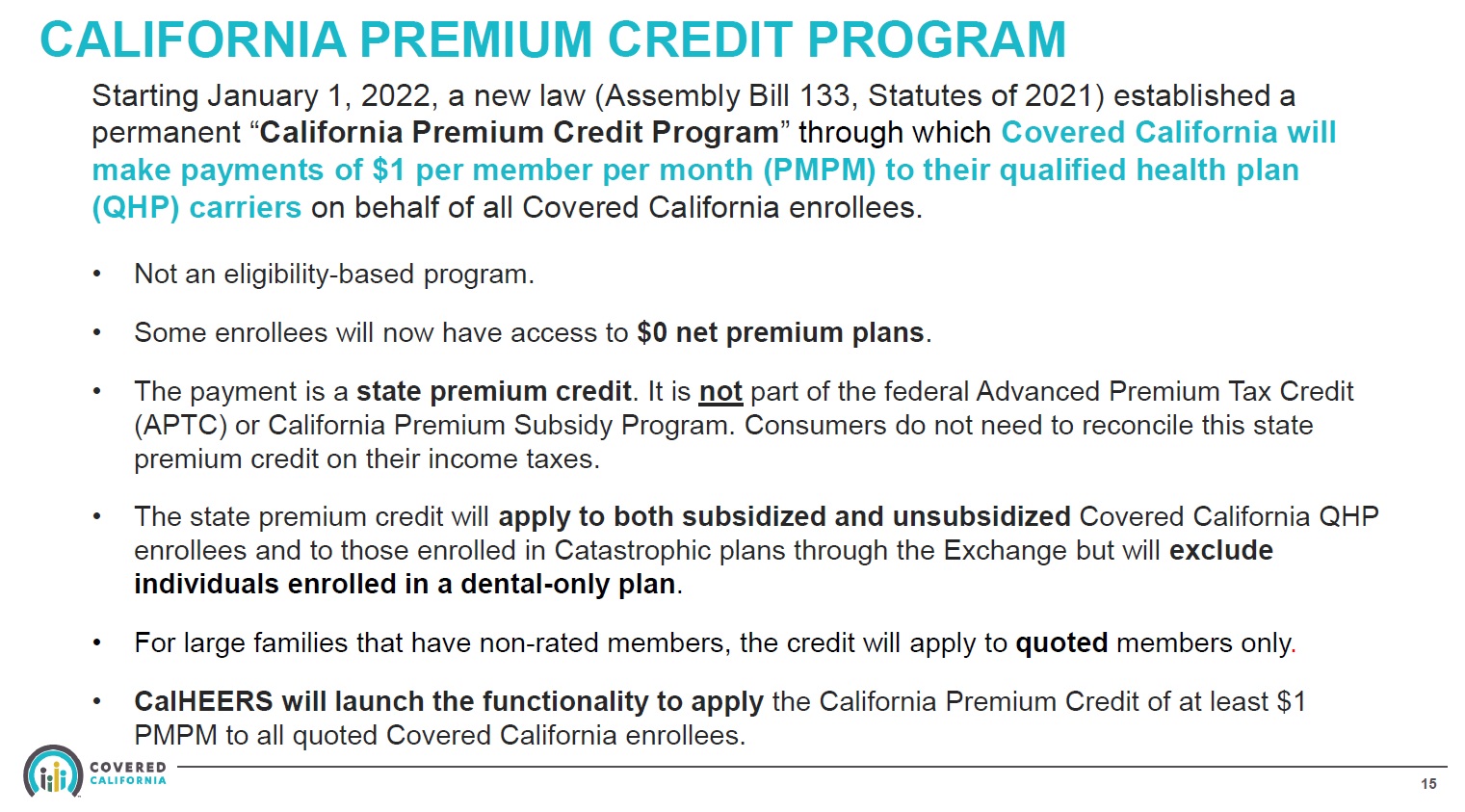

1 Dollar Covered California Member Bonus For 2022

California Announces Sales Tax Payment Plan For Small Businesses

California Will Tax Sales By Out Of State Sellers Starting April 1 2019

State Accepts Payment Plan In Folsom Ca 20 20 Tax Resolution

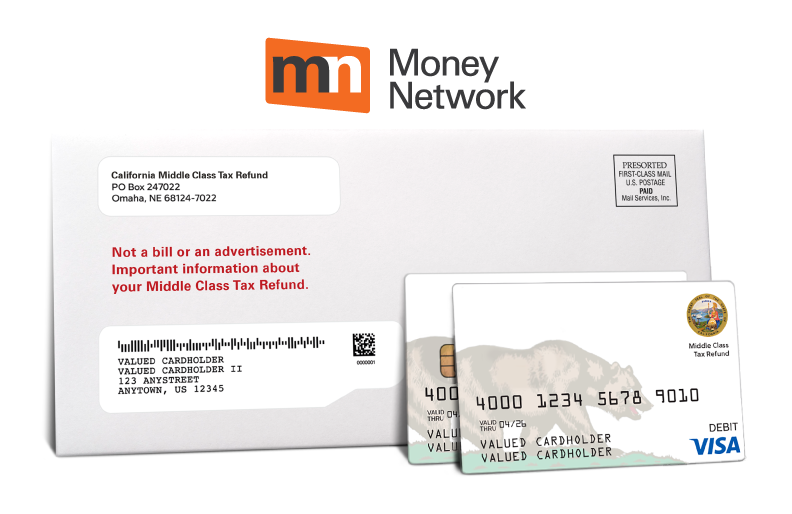

Middle Class Tax Refund Ftb Ca Gov

State Accepts Payment Plan In Murrieta Ca 20 20 Tax Resolution